A quartet of the Air Force's F-35A Lightning II fighters off Florida's northwest coast in May.

Part 3 of 5

Because of the “learning curve” and other problems in the Pentagon’s Selected Acquisition Reports (discussed in my prior post), objective observers need to find better data for measuring the cost of an F-35.More reliable and valid data are the empirical count of the dollars Congress and Defense Department have jointly directed at the F-35 program each year, divided that by the number of aircraft actually bought that year.

The math is simple, and calculation is straightforward, devoid of gimmicks. It brings a level of empirical reality to the cost calculation that the swamis of Pentagon cost gimmickry both hate and avoid. Fortunately, the numbers for making these real-world calculations are readily available in a convenient format, going all the way back to the beginning of the F-35 program in 1994 when it started to appear in unclassified budget presentations as the “JAST” (Joint Advanced Strike Technology) program.

The amounts are presented to Congress and the public as a part of the Defense Department comptroller’s annual budget materials in a document titled “Program Acquisition Costs by Weapon System.” (Reports for 1998-2014 are at the Comptroller’s website; editions before 1998 are available at the Pentagon’s Defense Technical Information Center’s website.)

These comptroller presentations separate out spending for R&D and for Procurement, and both Air Force and Navy costs are shown. (However, the materials do not separate out the Marines’ Short Take Off/Vertical Landing [STOVL] B model from the Navy’s aircraft carrier landing version, the F-35C. The two are combined into one Navy category.)

The annual reports also include the quantity of both Air Force and Navy aircraft procured, and each year’s presentation goes back two years to show any adjustments that may have occurred.The budget numbers shown include extra money Congress has sometimes added in its separate accounting for war funding, known as the Overseas Contingency Operations (OCO) budget, and they also include funds buried in obscure parts of appropriations bills, such as for “Modification of Inservice (Sic.) Aircraft,” “long lead” funding from previous years, and other less obvious accounts.

In other words, these cost and production data presented can be understood to be as complete and accurate as any available from the Department of Defense. And, unlike the SARs, these reports are routinely made available to the public, and they provide the latest updates, such as projections for 2014.

However, as with almost all Pentagon financial information, there is an important caveat: the numbers displayed are estimates; they have not been audited.

We have no independent assurance that all the money displayed was actually spent for F-35-related activities, nor that no other monies from outside the F-35 program were spent on the F-35. Nor do we have any verification from any impartial, external party that the number of aircraft stated to be authorized for purchase in any specific year were actually purchased and delivered to the Air Force or Navy. The annual spending totals in these reports frequently do not conform to the amounts in the Selected Acquisition Reports; sometimes the numbers are higher; sometimes they are lower. The number of aircraft purchased in one year, 2011, does not even match in these two documents. An audit to conform them is clearly needed.

The data in these annual “Program Acquisition Costs by Weapon System” reports are estimates, unverified by an independent audit, but that said, being the Pentagon’s chief financial officer’s report to Congress and the public, the data constitute the military’s most accurate accounting of the F-35’s cost.

These reports tell an interesting story.

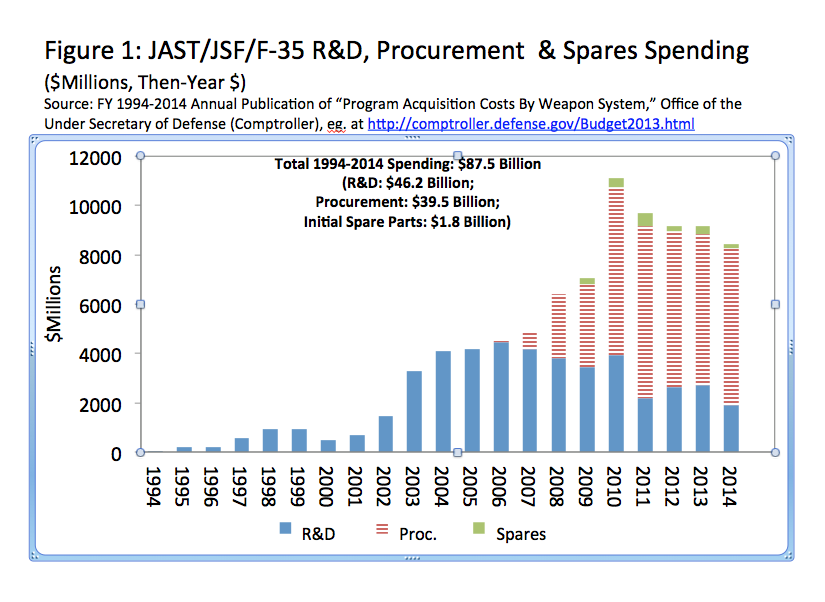

From the unclassified program’s origin in 1994 through President Obama’s 2014 budget request, $46.2 billion will have been spent on R&D for the JAST and Joint Strike Fighter (F-35) programs; $39.5 billion will have been spent on Procurement, and $1.8 billion will have been spent on separately-accounted initial spare parts.

That’s a grand total of $87.5 billion (then-year dollars; that is to say actual appropriations) spent through the end of 2014. See Figure 1 below for the annual allocations. Note how total F-35 spending has actually been decreasing since 2010 even though procurement spending has increased to more than $6 billion per year and has stabilized at roughly that level since 2010: it is R&D spending that has been declining, albeit somewhat erratically, thanks to the chaos in the F-35 program.

R&D spending is projected after 2014 to continue to ramp down to less than $50 million in 2018 as procurement spending increases to as much as $16 billion in 2021, two-and-a-half times the $6.4 billion requested in 2014 for procurement. Both the Air Force and Navy have other acquisition priorities competing for this same pot of procurement money, ranging from aerial refueling tankers and long range bombers, stepped-up ship buys, and a growing drone fleet. In the face of all this –and with the defense budget projected to grow only modestly, if at all — will the Air Force and Navy be able to more than double F-35 procurement spending? It is extremely problematic.

Without explaining whether he was citing a Program Acquisition Unit Cost, an Average Procurement Unit Cost or, most likely the Unit Recurring Flyaway cost, which will not result in a useable airplane (as explained earlier), Bogdan has asserted the unit price of the F-35 will get as low as $85 million. When it fails to reach that level for F-35s that can actually be flown, the Pentagon will find itself paying more for fewer aircraft. This has happened many times in the past; the F-22, which shrank dramatically in numbers bought but ballooned to well over $400 million per aircraft, is a relevant example.

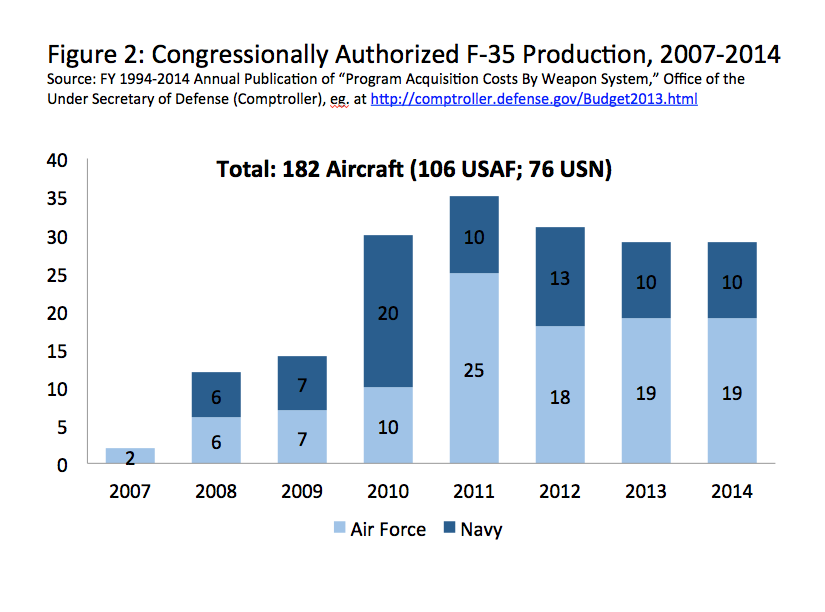

Figure 2 below shows that, according to these annual comptroller reports, 182 aircraft will have been authorized for purchase through 2014 — 106 for the Air Force and 76 for the Navy and Marine Corps.

According to the GAO, as of the end of 2012, 52 of the aircraft authorized to be purchased have been delivered. In May 2013, Lockheed asserted that 81 aircraft had been “rolled out” of its factory in Fort Worth, and the new SAR states that only 50 have been delivered “to date” (which is not specified); the discrepancies are unexplained. Also, the GAO reports that 179, not 182, aircraft will have been authorized by the end of 2014. (Clearly, these data need to be audited by an independent party.)

With the information displayed in figures 1 and 2, we can easily calculate what it has cost each year to buy an F-35. Because the prediction is that the production costs will come down to the neighborhood of $85 million each (thanks to the production learning curve and the end of R&D spending), it is most appropriate to restrict the cost analysis here to just procurement spending.

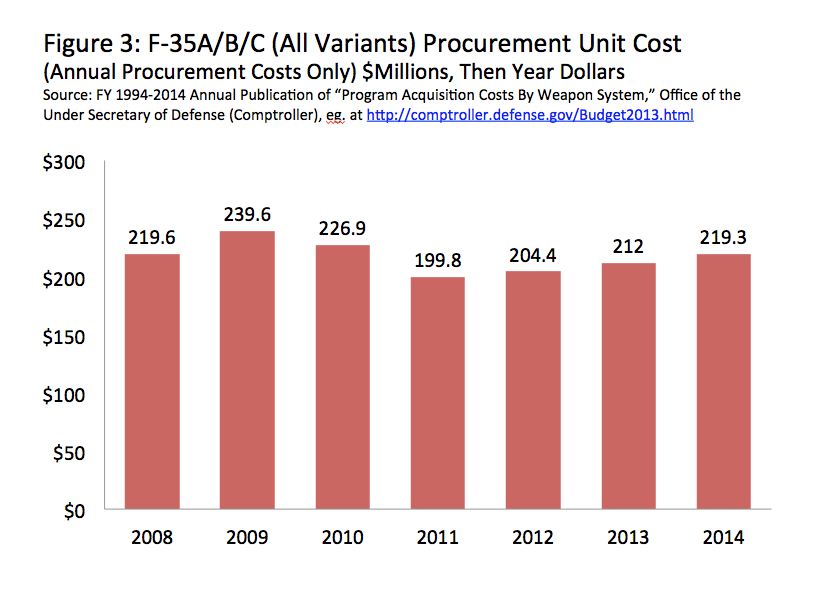

Figure 3 shows the procurement unit cost of each annual batch of F-35’s since 2008—that is, annual procurement cost divided by the number of aircraft authorized by Congress to be purchased in that same year. This figure combines average annual unit cost of both Air Force and Navy versions of the aircraft; the display can be considered the unit production cost of a generic F-35 in each year. Available data indicate that the discrepancy of authorized aircraft between GAO and DOD Comptroller reporting pertains to three Air Force aircraft in 2011.

Two technical and three fundamental points are notable for these data.

— First (technically), because the costs for producing the first two F-35As for the Air Force in 2007 were inordinately high due to initial set-up costs and the unique inefficiencies of first production, the unit price in 2007 ($406.8 million) is not displayed. With the scale in the graph reduced to $300 million annual differences are more detectable.

— Second (technically), the lowest unit cost shown is for 2011, but the production quantity for that year assumes the accuracy of the Pentagon comptroller’s reports to Congress and the public. Given chaos in Congress’ 2011 appropriations, it is also possible that 32 aircraft were authorized by Congress, not the 35 displayed by the comptroller in his final display for 2011 in his “Program Acquisition Costs by Weapon System” publications. In that case, the 2011 unit cost calculates to $218.5 million (not $199.8 million), which makes 2011 no longer such a low point, or as much an anomaly. (Again, it should be quite clear that the entire F-35 program needs a thorough audit by an independent entity.)

However, of more fundamental importance, the following are notable.

— First, contemporary F-35 unit costs are today in excess of $200 million, well above the Average Procurement Unit Costs (APUCs) and Program Acquisition Unit Costs (PAUCs) that the military’s Selected Acquisition Reports report to be unit costs for the complete F-35 program. It should also be noted that contemporary unit costs are literally a multiple of the commonly cited Unit Recurring Flyaway (URF) cost ($78.7 million—for the F-35A) or of the $85 million envisioned in the future by the program manager, General Bogdan. (See my second post for a discussion of these acronyms and the flawed cost calculations they represent.) The program has a very, very long way to go to even begin to approach the learning curve reductions that the official documentation for the program predicts.

— Second, by the end of 2014, the F-35 will have been produced in significant annual amounts for seven years. The statement of Vice Admiral David Dunaway of the Naval Air Systems Command that the F-35 is now a “fairly mature air vehicle” is accurate—regarding production. There has been ample opportunity for the learning curve to have demonstrated some level of decreasing unit cost—for Lockheed and its major subcontractors to have worked out the kinks associated with manufacturing any new complex piece of hardware.

— Third, there is a discernible trend in F-35 fabrication costs: they are increasing. As figure 3 clearly shows, they have been rising since 2011 (or since 2012, if the comptroller’s reports are wrong and the 2011 unit cost was $218.5 million, not $199.8 million).

Moreover, the unit costs have been increasing significantly: by $19.5 million or 9.7% since the $199.8 million from the comptroller’s data for 2011, and by $14.5 million or 7.2% since 2012.

Reasons for the increase in the already-high unit costs are becoming clear. As shown by the Defense Department’s reports on F-35 testing, a remarkable number of significant F-35 components — even the airframe itself — have shown serious problems requiring redesign. That means the F-35’s design has always been in flux. Paying for changes in mid-assembly is proving to cost more than whatever efficiencies might be achieved elsewhere. So long as the F-35 configuration continues to change, there can be no meaningful learning curve.

Future years may prove even more costly: more stringent testing is still in the future and will not finish until 2019 at the earliest. Still more issues may arise once the aircraft enters the operational force.

What are we to make of the statements from Hagel and Bogdan that F-35 costs are “coming down”?

Sometimes in the past, such statements have referred to contract “target” prices—that is, before cost overruns are counted. Sometimes they ignore some actual F-35 costs, such as appropriations for “Modification of Inservice Aircraft” or “long lead” funding from the previous year.

In Bogdan’s case, he appears to have been referring to the reduction that did occur from the lot 4 purchase in 2010, to the next lot 5 purchase in 2011. There was a reduction of up to 12% — from $226.9 million in 2010, to $199.8 million (or perhaps $218.5 million) in 2011.

But that is a reduction that occurred two years ago. To say the unit costs “are coming down” or “continues to come down” is—to put it as politely as possible—grammatically incorrect. It came down then; it is going up now.

The Pentagon’s latest SAR asserts that the PAUC, APUC and URF (all unit cost calculations based on selections of total program data and described in my second post) have each come down since last year. However, the basis for the total program “savings” declared by the 2013 SAR are founded in a fragile prediction that labor costs will come down in the next 25 years (compared to last year’s prediction), and that savings have been extracted from contracts that actually went up in cost. The unit-cost savings declared by the 2013 SAR have every appearance of being driven by thinking that can charitably be described as “wishful.”

The empirical numbers from the Defense Department comptroller’s annual “Program Acquisition by Weapon Systems” reports are straightforward, and the trend is clear:

— From 2012 to 2013, F-35 unit cost increased by $7.6 million, or 3.7%.

— From 2013 to 2014 it will have increased another $7.3 million, or 3.4%.

The continuing magnitude of F-35 unit costs is notable: they are costing significantly more than $200 million each, specifically $219.3 million in 2014.

Different planes, common problems. We’ll address that in our next, penultimate, post.

Part 1: The Era of Good F-35 Feelings

Part 2: Alphabet Soup: PAUCs, APUCs, URFs, Cost Variances and Other Pricing Dodges

Part 3: The Deadly Empirical Data