Military retirees know that their family insurance payments under the so-called Tricare program — $460 a year, where they have been since 1995 — are going the way of the gramophone record. Given that hikes are inevitable, their leaders are telling them they should embrace the modest fee increases currently proposed — and then push for caps in federal law so they can’t skyrocket in the future.

Retired Air Force colonel Steve Strobridge of the Military Officers Association of America lays out the steep challenge facing military retirees trying to keep their premiums flat:

One key tenet is to defuse the biggest argument working against you. On the TRICARE front, that argument is “TRICARE fees haven’t been raised since 1995.” That’s a conversation-stopping statement when you’re talking to almost any legislator or civilian. When we first started these battles, it was “no fee increases in 10 years.” Now, it’s “no fee increases in 16 years.” No matter how good our other rationale is, that argument is a potential killer, and it gets stronger with each passing year.

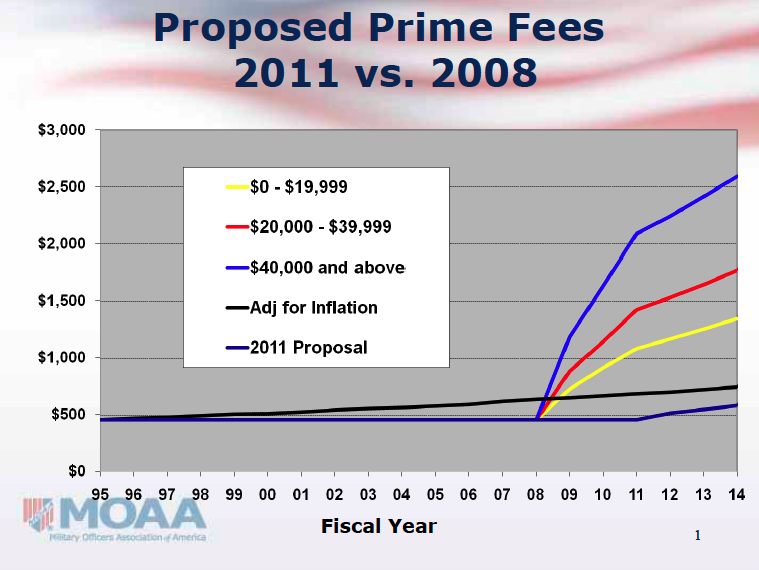

MOAA is working with congressional committees, and calling on its members to support the slight boost in fees the Pentagon is proposing they pay. Strobridge even has produced a handy chart showing 2008’s steep hikes — which were defeated — with the “most modest” increases currently pending.

The straight fact is military retired pay has increased nearly 50 percent since 1995, so it’s pretty difficult to argue that a $5 a month TRICARE Prime fee increase after 16 years is unaffordable.

Ya think?