A U.S. Air Force F-22 Raptor ascends.

As the industry’s all-important Paris Air Show gets underway, the outlook for the defense sector appears like a UFO blip on a radar screen: something’s definitely there, but how much of a threat it poses is uncertain.

One thing, however, is clear: while commercial aerospace is booming, investments in aerospace defense in most Western countries is not. In fact, it’s declining.

So where is business in the defense sector of the aerospace industry headed? I was recently part of a comprehensive analysis of sector and company financials as well as key industry trends, the AlixPartners Global Aerospace & Defense Industry Outlook.

That analysis reveals much about the new world order in aerospace defense as well as the future outlook for the industry. Here’s a brief summary of the report’s high points.

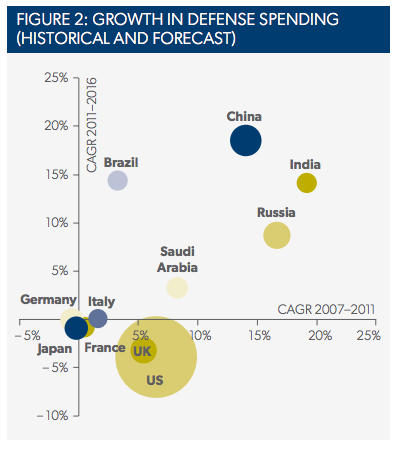

— The war on cost is heating up in the defense sector as companies are simultaneously chasing fewer revenue opportunities in Western nations, and facing stiffer competition for a slice of the emerging-market pie. Driven by retrenchment in the U.S. and Europe, global defense spending fell in 2012 for the first time since the 1998 spending drop, to $1.7 trillion in 2012. At the same time, the proportion of global spending by China and Russia is increasing, and by 2016 those two countries will make up almost a third (32%) of global spending by the “top 5” spenders (vs. just 17% in 2011).

— Virtually every part of the aerospace and defense business is taking another look at costs, searching for efficiencies and struggling to stay ahead of the changing environments in which they do business. With the huge number of changes happening all at once, identifying and keeping ahead of trends is what will generate long-term success.

— With China and Russia being largely inaccessible to Western defense companies, this phenomenon is further squeezing the market for Western companies. This is expected to drive intense competition to capture export business in accessible emerging markets, such as Brazil and India. Furthermore, traditional selling strategies are coming under great pressure and competitions in export markets – particularly for combat aircraft – are increasingly becoming ‘winner-takes-all’ deals.

— Those with more balanced portfolios, such as lower-tier suppliers, will more easily be able to tackle the challenges of this new environment than will most OEMs, many of whom today are 80% reliant on defense and 75% of whom are dependent on U.S. and European markets. Moreover, the cyber security market – viewed by many as the “saving grace” of Western defense companies – will likely not grow enough to compensate for declining defense spending.

The key to not only compete but thrive in this environment may very well be for defense firms to focus on improving both domestic programs’ affordability and competitiveness in emerging markets. Selling defense solutions in growing emerging markets, however, requires more complex technology and manufacturing partnerships as those countries seek to develop their own A&D industries.

Aside from defense growth in emerging markets, the homeland-security market globally, projected by the study to grow to $281 billion by 2022, represents another potential path to profitability. Defense companies that can leverage their program management, integration experience and government-contracting skills will be most able to take advantage of this opportunity.

David Fitzpatrick is a managing director at AlixPartners, the global business-advisory firm, and is leader of the firm’s Aerospace & Defense Practice in North America. He is a 29-year veteran of the aerospace industry and works with defense companies, commercial aerospace OEMs and suppliers, and airlines on a range of strategic, operational and performance improvement matters.