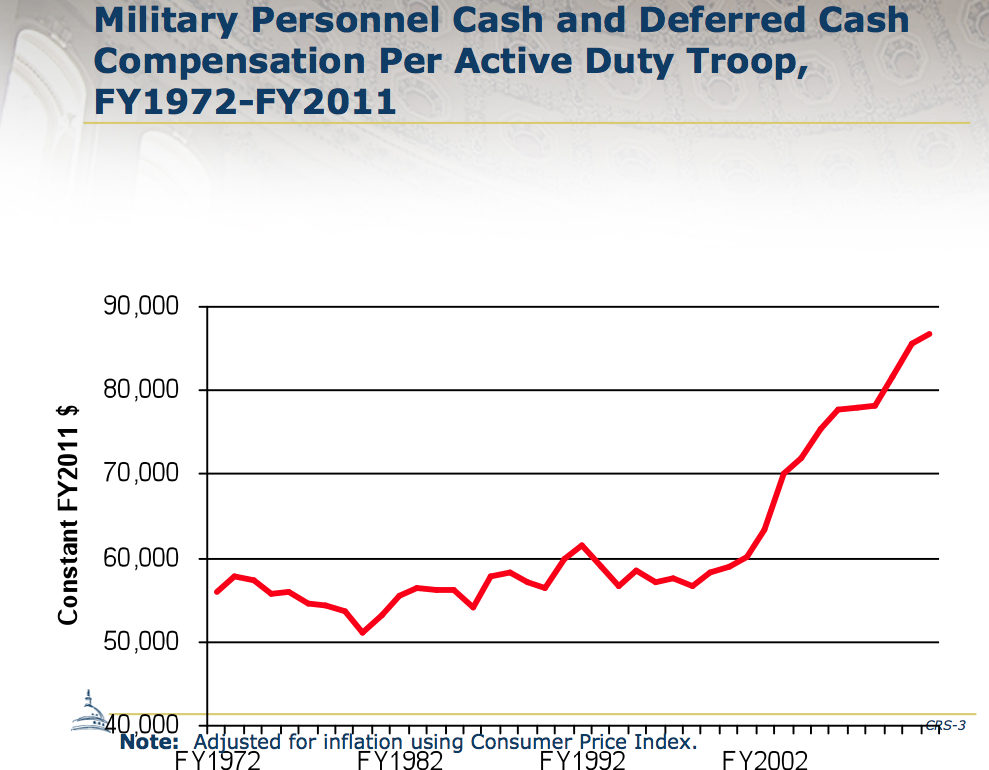

The chart makes it clear: military pay — including retirement and health benefits — is no longer small beer. While self-described mega-rich man Warren Buffett said Monday on the op-ed page of the New York Times that “the poor and middle class fight for us in Afghanistan,” the truth is that the average soldier is paid, in cash and benefits, more than 80% of civilians with similar education and job skills.

Now the next battle seems to be looming over the military retirement system, which gives troops — but only those who have served 20 or more years — a lifetime pension equal to half their cash compensation. Trouble is, enlisted folks often start pocketing that at 38, while their officers can begin collecting at 42. This World War II, industrial-era, system made sense when people died at 65, but it makes no sense when many retired troops are living into their 80s and launching post-military careers.

A recent accounting by military expert Stephen Daggett of the Congressional Research Service (who drafted the chart) shows the following hikes in per-troop compensation categories (absent inflation) since 1998:

— Basic pay: up 20%

— Housing allowance: up 188%

— Bonuses: up 56%

— Retirement accounts: up 24%

— Total compensation, per troop: up 51%

Most of these changes have been ordered by Congress, which is under relentless pressure from groups like the Military Officers Association of America to increase pay and benefits. Lawmakers have ignored Pentagon requests to limit troop raises to the so-called Employment Cost Index, and instead have given them that — plus an additional 0.5% increase — in nine of the past 10 years. There have been a host of other compensation increases involving housing and retirement benefits that are so complicated only advocates understand them.

Retirement spending looks like the next target in the crosshairs. There is no logic to a system that pays nothing in retirement if you leave the job before spending 20 years in it. That’s why the Pentagon’s Defense Business Board is recommending something more like a civilian 401k plan, bolstered by government contributions. It could save taxpayers $250 billion over 20 years.